Are You Sitting On A Tax Time Bomb?

“What is the difference between a taxidermist and tax collector? The taxidermist only takes your skin.” Mark Twain In our hyper-politicized social climate few sentiments unite Americans like the desire to pay the least amount of taxes possible. This feeling is echoed among millions of Americans every April when our

Where is Your Margaritaville?

Over Labor Day weekend 2023 Jimmy Buffett, one of America’s most beloved and iconic entertainers, passed away at the age of 76. Best known for his 1977 hit single “Margaritaville,” Jimmy Buffett parlayed his Caribbean beach bum song stylings into an unrivaled entertainment and business empire. Over the course of

Who We Serve and How We Can Help

By Phil Bollin, CERTIFIED FINANCIAL PLANNER™ In today’s unpredictable financial environment, finding the right financial advisor can be challenging—but not impossible. Whether you do your research online, ask for recommendations from friends or trusted advisors, or both, the amount of choices to sift through can be mind-boggling. It has gotten

See a Sample Financial Plan from Bollin Wealth Management

By Phil Bollin, CERTIFIED FINANCIAL PLANNER™ We live in a data-driven world. No doubt about it. Anything and everything you could want to know is just a tap or a click away. But unless you’re experienced at collating pertinent data, your quest for a customized answer is often lost in

VIDEO: Happy Thanksgiving! Here’s What We Are Grateful For

By Phil Bollin, CERTIFIED FINANCIAL PLANNER™ At certain times of the year, or when certain events occur, we are reminded of how blessed and fortunate we are, and we are compelled to give thanks. November is one of those times of the year when, as a nation, we set aside

The 3 Biggest Financial Planning Challenges for Engineers

By Phil Bollin, CERTIFIED FINANCIAL PLANNER™ Engineers and technical professionals are known for their precision—but when it comes to their finances, the numbers aren’t always as straightforward. While they may be high-earners, their unique compensation and investment packages often require custom strategies to help them lower their tax exposure and

What Is a Fee-Only Financial Advisor & Why Does it Matter?

If you’re searching for a financial planning professional, the first thing you’ll want to ask is how this advisor will be paid. If you hear they’re fee-only, you’re on the right track. Fee-only financial advisors are paid directly by their clients.

Why I Became a Financial Planner

Next year will mark the 30-year anniversary of one of the most popular movies from the ’90s, Forrest Gump. Of all the memorable moments in that movie, one phrase seems to be quoted most often:

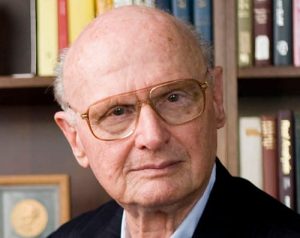

The Legacy of Dr. Harry Markowitz

Dr. Harry Markowitz revolutionized the way investment portfolios are constructed.

First Quarter Investment Review

Despite many mixed signals about the health of the economy, the first quarter of 2023 generally saw some positive developments for both domestic and global investment markets. While this is by no means a signal that markets are well on their way to a full recovery, it is nevertheless important

What Can We Learn About Investing from March Madness?

Every year in mid-March millions of Americans flock to their televisions to watch dozens of games in the NCAA men’s basketball tournament. March Madness is such a popular sporting event that it is estimated that one-in-four Americans fill out brackets annually, attempting to pick the overall tournament winner and perhaps

When Banks Fail, What Can You Bank On?

Successful investors can more easily ignore that urge and the noise that comes from day-to-day market movements, knowing that planning for what can happen is a more powerful strategy than trying to anticipate and predict what will happen next.