The narrative for fund managers has been that 2024 is a stock-picker’s market. The traditional school of thought has been that active managers should excel when the gap beteen winners and loser is wide like we have seen in the early months of 2024. Either the narrative is wrong, or fund managers have not gotten any better at picking winners than they have been in the past.

Through the first half of

2024 only 18.2% of actively-managed mutual fund and exchange-traded fund

managers have outperformed their S&P 500 Index benchmark according to

Morningstar. This is a much worse track record than we would expect from

randomly flipping a coin to pick our winners and losers. Perhaps active

managers shouldn’t feel too bad for their performance in 2024, only 19.2% of

active managers outpeformed the S&P 500 in the first half of 2023. For all of 2023, active managers’ performance

only improved to 19.8% of managers outperforming the S&P 500 Morningstar

reports.

But active managers’

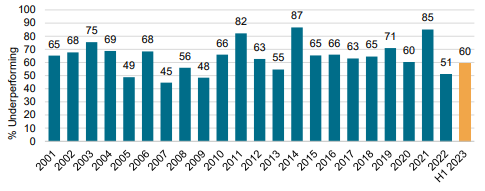

lackluster prognostication efforts are not a recent development. Data collected

by S&P Dow Jones Indices LLC shows that only three times since 2001 have

the aggregate of active managers outperformed the S&P 500 Index: 2005, 2007

and 2009. In most years two-thirds or

more of active managers underperform the benchmark index.

Percentage of Large-Cap Domestic Equity Funds Under performing the S&P 500 Index.

Source: S&P Dow Jones Indices LLC. Data as of June 30, 2023. Chart is provided for illustrative purposes only and is not indicative of future performance.

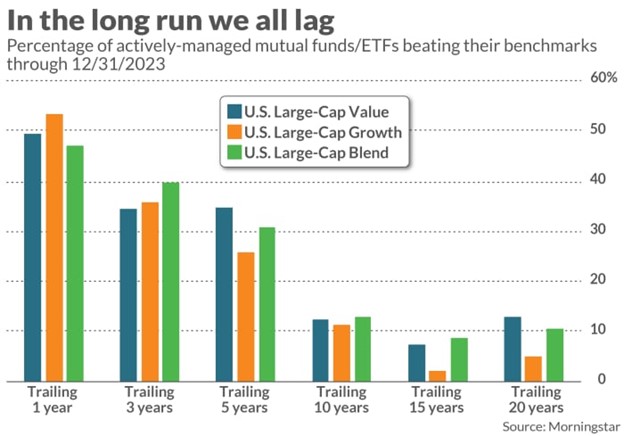

Morningstar’s long-term data about active managers tells a similar story. As the graph below illustrates, once time horizons extend beyond five to ten years performance for active managers drops off considerably. There can only be one of two explanations for this observation: either active fund managers get worse at their craft the longer they work or eventually their luck runs out. Logic would suggest that the latter explanation is much more plausible.

None of this evidence will dissuade Wall Street from

continuing to market their stock-picking and market-timing prowess through

actively managed mutual funds and exchange-traded funds. Nor will it deter some

investors from seeking out funds and managers who can successfully navigate the

ups and downs of equity markets by picking the right stocks and timing markets

successfully, avoiding short-term investment losses along the way.

Educated investors know there is a better way to invest for more consistently successful investment experiences and financial outcomes. They know that chasing performance and trying to find the better mousetrap usually leads to disappointment and obstacles to achieving financial goals.

The next time you read about high-flying stocks like Nvidia and Tesla or run across the advertisement for the next great five-star active fund manager, remember what the irrefutable data tells us: sooner or later all active fund managers’ luck eventually runs out.

Sources: Morningstar, S&P Dow Jones Indices LLC, The Wall Street Journal