Domestic and international equity markets experienced sharp selloffs in the first quarter of 2022, leading to widespread investor concern.

Compounding the bad news from equity returns in the first quarter are three factors causing anxiety for investors: 1) high inflation rates that haven’t been seen in 40 years, 2) the Russian invasion of Ukraine in February which threatens geopolitical stability in Europe and compounds the supply chain issues contributing to the four-decade high rates of inflation and 3) steep losses in bond markets arising from the Federal Reserve’s aggressive rate increases aimed at staving off high inflation.

With all that unwelcome news occurring in such a short period of time, is it any wonder investors are looking for something that gives them a glimmer of hope? Dimensional Fund Advisors (DFA), with their long-term focus on market discipline and investing fundamentals, does not let us down with a recently published study about equity markets.

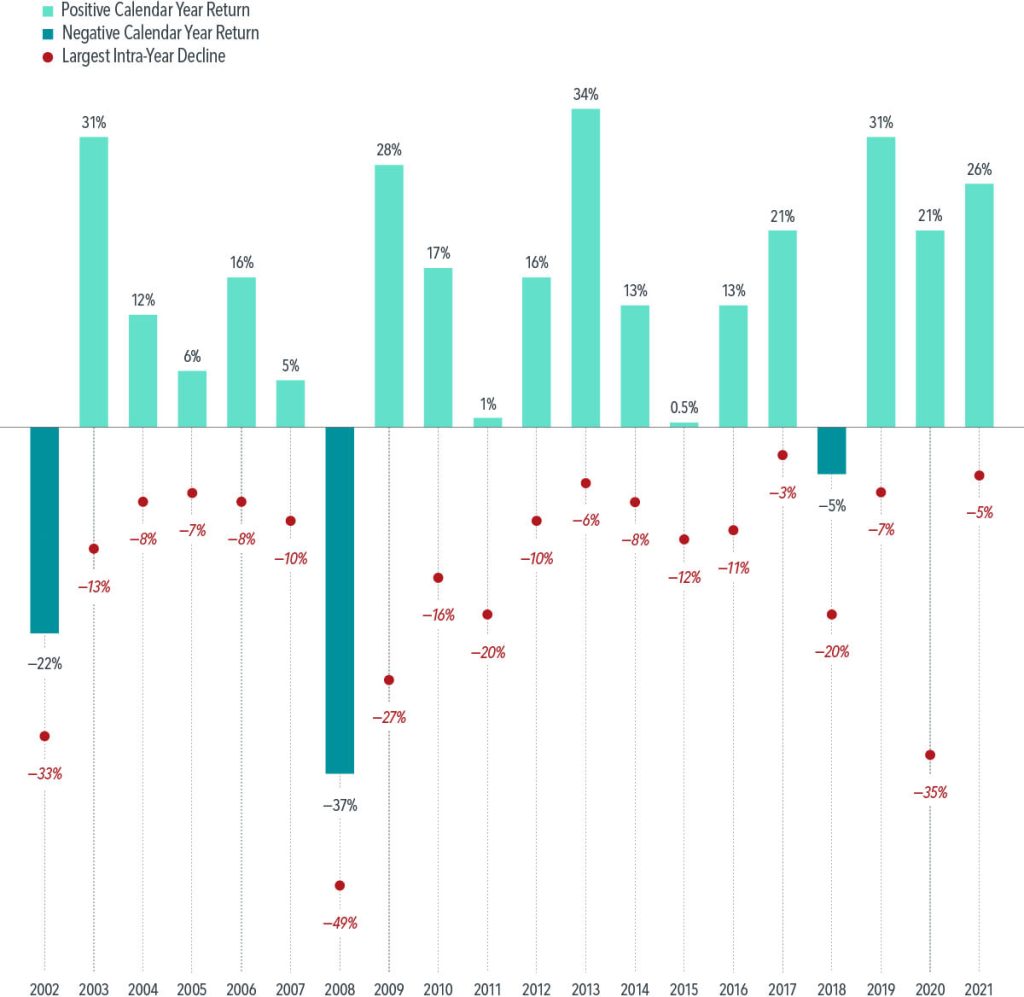

Compiling twenty years of data from January of 2002 through December of 2021, DFA examines the relationship between intra-year market declines and annual returns for the Russell 3000 index, a popular representation of the entire US stock market. There are a few very surprising takeaways from DFA’s research.

In every single year in the study, the Russell 3000 index experienced an intra-year decline. In some years, the intra-year decline was very benign with the lowest intra-year decline of only 3% occurring in 2017. In other years, the intra-year decline was quite large, with the worst decline of negative 49% occurring in 2008. Over the twenty-year timeframe, the Russell 3000 saw intra-year market declines of 30% or more three times, and declines of 20% or more six times! Stated another way, in 30% of the years, the Russell 3000 endured bear-like market declines during the year.

In how many of those years did the market finish with negative returns? In only three of the years examined, the Russell 3000 index experience negative annual returns: -22% in 2002, -37% in 2008, and -5% in 2018. Exhibit one shows that there is little to no correlation between the magnitude of the intra-year market decline and the resulting year-end market returns.

DFA’s study and chart provide some key take-aways for investors. Volatility is a normal part of equity investing. Market declines should be expected, even embraced, by investors. Market declines are signs that markets are functioning efficiently.

Finally, having a long-term focus can give investors focus and discipline, preventing investors from derailing their financial plans with rash investment decisions based on market volatility.

Source: Dimensional Fund Advisors, LP