We are only halfway through 2022, but most Americans have had enough bad economic and investment news to last several years. How bad were the first six months of 2022? Early in 2022 inflation touched rates that have not been seen in forty years, inflicting widespread pain on Americans whenever they fueled their vehicles, purchased food, or paid their energy bills.

On top of inflationary hardships, stock markets experienced heavy losses during the first six months of the year, led by the Nasdaq Composite Index’s loss of 29.5%. The S&P 500 Index had its worst first half of the year since 1970, with a -20.6% return. Traditional safe havens for investors, bond markets offered no relief from stock market volatility as bonds experienced their biggest selloff in four decades. Investment-grade corporate bonds lost 17% of their value in the first half of 2022 and Treasury Bonds with 7 to 10-year maturities lost 11%.

To make matters worse the specter of a recession looms over an already struggling economy. Goldman Sachs recently placed the odds of a recession at 50% in their ‘base case’ scenario. The Wall Street Journal economists about the economy’s health in January and June. In January the economists surveyed by the Wall Street Journal put the odds an economic recession in the next twelve months at 18%. Five months later in June, the economists put the odds of recession at 44%. All the bad economic and investment news that has compounded over the past six months was reflected in June’s University of Michigan Consumer Sentiment measure, which measured an all-time low for consumer economic confidence.

With all the bad economic and investment news over the past six months, should investors have any optimism for the second half of 2022? More importantly, what moves can investors make to shore up their investment portfolios?

What Moves Can Investors Make Now?

Let us start with the question of what potential moves can investors make now? In recent years, investors who were tempted to exit equity markets during a downturn had safe havens to place money. Bonds and cash have historically provided refuge for investors seeking safety from equity market volatility. At the moment, neither cash nor bonds are attractive for investors as bonds lose value every time the Federal Reserve raises interest rates and inflation erodes the purchasing power of idle cash.

If we were in an environment more favorable to bonds and cash, would timing the market by exiting equities be the best move for investors? There is a great deal of evidence that suggests otherwise.

Daily market movements are predicated on new development that inform investors’ decisions to buy, sell or hold investments. These developments are, by their nature, unpredictable. Some developments and events are viewed positively by investors in aggregate, and some developments and events are going to be viewed negatively by most investors. Over the history of the S&P 500 Index, daily returns have been positive approximately 54% of the time and negative 46% of the time. Despite that narrow margin between positive and negative daily returns, the S&P 500 Index has managed to produce a 10% annualized rate of return for investors.

These split between positive and negative market returns days is only slightly better than a random flip of a coin, which has a 50% probability of landing on heads or tails. Would rational investors gamble their hard-earned savings on the results of a 50/50 flip of a coin? For most rational investors that answer is a hard “NO!” Yet that is what investors are doing when they attempt to time the market: gambling with their financial future.

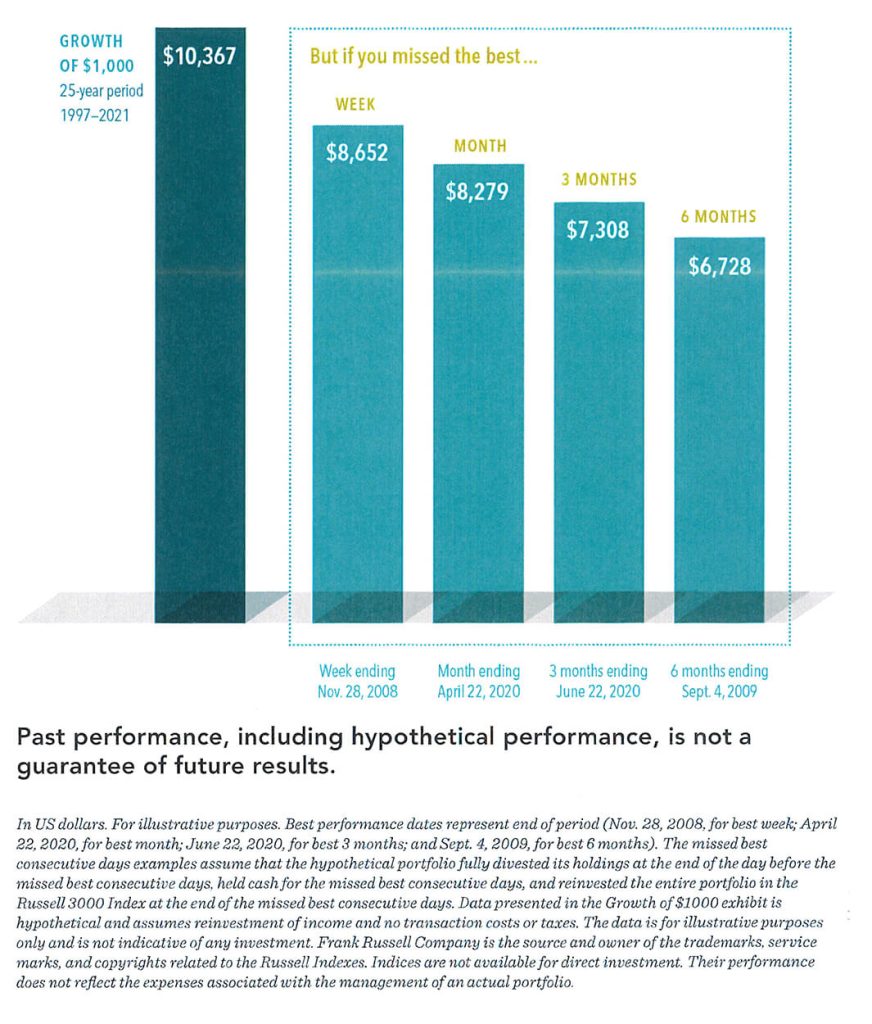

Guessing incorrectly about what days to be in the market can be very costly as Exhibit 1 illustrates. Missing just one week of the best market returns can be devastating to your investment results.

Consider the performance of the Russell 3000 Index for the twenty-five-year period from January 1, 1997, through December 31, 2021. Missing the week ending November 28th, 2008 (just 0.08% of the entire twenty-five year period) lowered investment returns by an astounding 16.5%!

Missing out on the best six months (2% of the entire period) resulted in missing out on 35.1% of market returns! Investors concerned about market performance should pause and consider the following steps before making any changes to their investment strategy.

- Ask yourself why are you investing in the first place? What goals are incorporated in your financial plan? Would exiting equity markets make you more or less likely to achieve your financial goals? The answer to the last question is almost always “less likely” for all investors.

- Ask yourself whether your portfolio allocation supports your financial goals. If your financial plan requires a 7% return on your investments to provide the retirement income you need, what will reducing your equity positions do to your plan? Will you be more or less likely to reach your goal by moving out of the market? For most investors and retirees, the answer is going to be less likely!

- Focus on the things you can control. Save more money and spend less. Focus on lower investment costs. There are many factors out of our control as investors, but we can greatly improve our odds for success by being disciplined.

Disciplined, long-term investors have a tremendous track record of success, despite the market volatility, shocks and gyrations that occasionally occur. The best part is that long-term investors capture equity market returns without having to gamble on the direction of the market.

Are There Reasons for Investors to Be Optimistic?

We have experienced the worst bond market in four decades and the worst first half for returns for the S&P 500 Index since 1970. Is there any reason to be optimistic about market returns in the next six months? It turns out there is evidence that suggests investors might feel optimistic about better market returns for the last half of 2022.

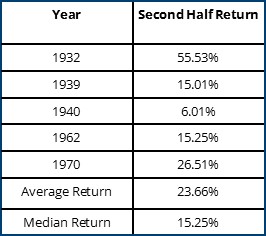

Since 1932 the S&P 500 Index has experienced market declines of 15% or more in the first six months of the year five times. This occurred in 1932, 1939, 1940, 1962 and 1970. In each of those five years, the next six months produced a positive return for the index. In fact, the average return in the second half of the year for those five years was +23.66%!

Exhibit 2 shows the second half returns by year for each of the five years with 15% or greater market declines in the first half of the year.