After the worst year for equity markets in a decade, some investors may be asking themselves “what now?” It is not unusual for investors to question their investment decisions and investment allocations after a year where very little seemed to go right for equity markets. After a trying year in 2018, what does the new year hold for investors, and how can you prepare for the year ahead?

The Outlook for Equity Markets

Forecasting equity market returns for the upcoming year is difficult, even for the most seasoned investment manager. Market “experts” routinely provide forecasts and predictions for the year ahead. How often are their predictions correct? We will never know, because rarely is there any follow up on any of these forecasts. The fact is that it is impossible to know how markets are going to perform in one day, one week, one month or even one year. We do know, however, how markets perform historically. We can accurately forecast how equity markets will perform over longer periods of time for planning purposes. This is where we should focus our attention and efforts.

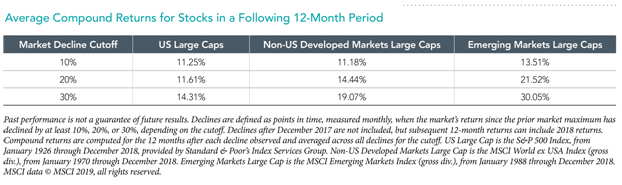

We also know that after market declines of 10% or more, which we experienced in the 4th quarter of 2018, equity returns have been positive 71% of the time for U.S. equity markets following the downturn. International developed markets have seen positive equity returns 72% of the time after market declines of 10% or more. As the table depicted below indicates, markets often rebound sharply over a twelve-month period after a significant correction of ten, twenty or even thirty percent. Armed with that knowledge, we know that markets are likely to reverse course in the not-too-distant future.

The Outlook for Fixed Income Markets

Fixed income markets did not provide much in the way of returns in 2018, nor did they hurt most investors. It appears that 2019 may be very similar. While interest rates in the U.S. have inched up from their historic lows, they are still below historical norms. The Federal Reserve raised the Fed Funds Rate (other interest rates are based off the Fed Funds Rate) to 2.5% in December. The Federal Reserve has expressed a desire to hit a 3.0% rate in 2019, so small, measured increases seem probable during the year.

Globally, 2018 saw interest rates increase in the United Kingdom, while Germany and Japan experienced interest rate decreases. The outlook for international fixed income markets remains cloudy, given the variation and disparity in interest rate movements among major global economies.

For all of the reasons outlined above, sticking to a strategy of investing in short maturity fixed income instruments is the prudent move for the near future. When interest rates begin to approach historically “normal” interest rate levels, we will recommend going longer on the yield curve and extending the maturities of fixed income instruments.

Final Thoughts & Advice for 2019

While we cannot control investment markets, we can control how we invest and react to market conditions. Tune out the “noise” that inevitably arises from the media when investment markets or the economy experience normal and healthy corrections and contractions. Following the media typically leads to poor decisions, and even worse investment results when compared to disciplined investment strategies.