Coming off an especially strong year for equity investment returns, it is not unusual for investors to ask “what’s next?” for markets in 2022. There may be no more appropriate answer to that question than the standard investment disclosure of “past performance is no guarantee of future results.” As we have pointed out repeatedly in the past, it is a fool’s errand to try to predict what will occur in investment markets in the short term. We can anticipate some economic and market developments, however, and prepare for the impact on our strategic financial plan.

Inflation to Continue

Increasing Interest Rates

Market Volatility Expected

Discipline & Diversification are Rewarded Over Time

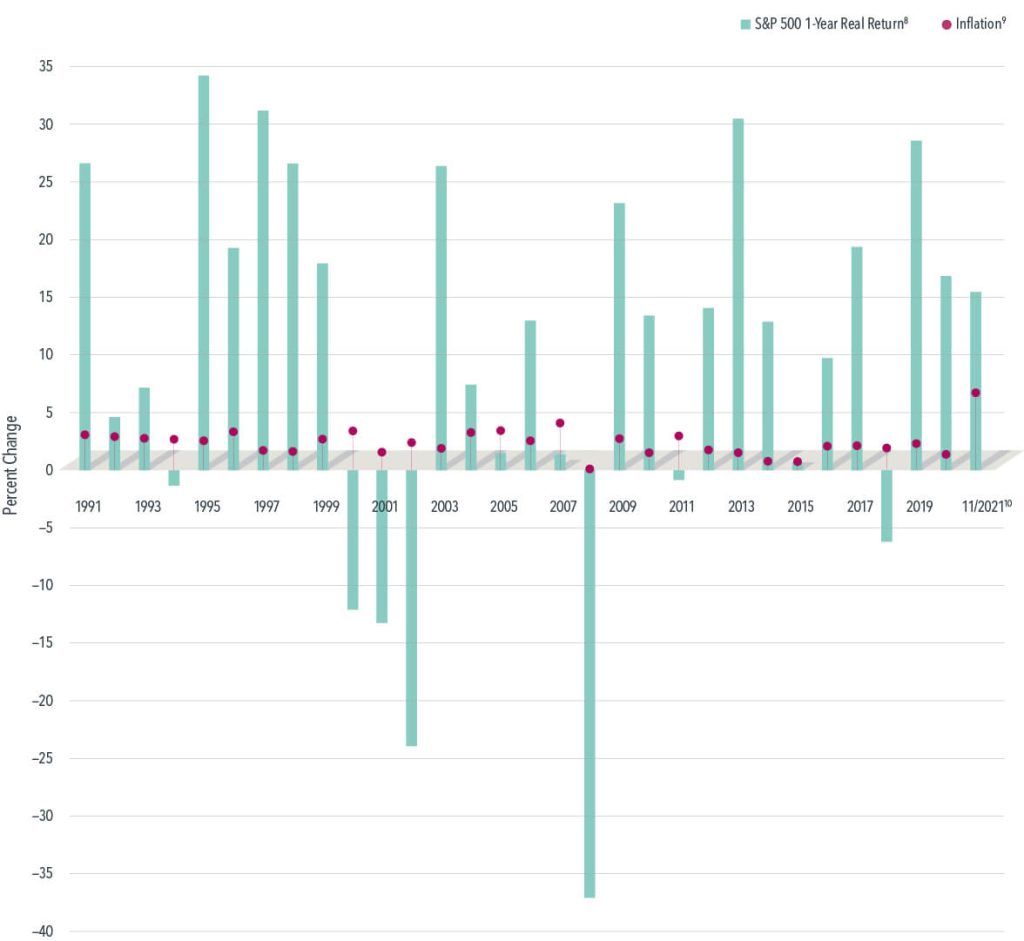

It is unlikely that equity markets will continue their torrid pace of the past three years indefinitely. But does that mean a market correction is imminent? Regardless of what transpires in investment markets in 2022, there are principles and fundamentals that should always be followed. Disciplined asset allocations, portfolio rebalancing, and focusing on keeping investment costs low are proven strategies that reward investors in the long run. To make sure your financial plan is ready for whatever transpires in 2022, schedule a meeting with Bollin Wealth Management today.