“May you live in interesting times,” purportedly the English translation of a traditional Chinese curse, may very well be the best expression to summarize 2020. It was a year unlike any we have experienced before.

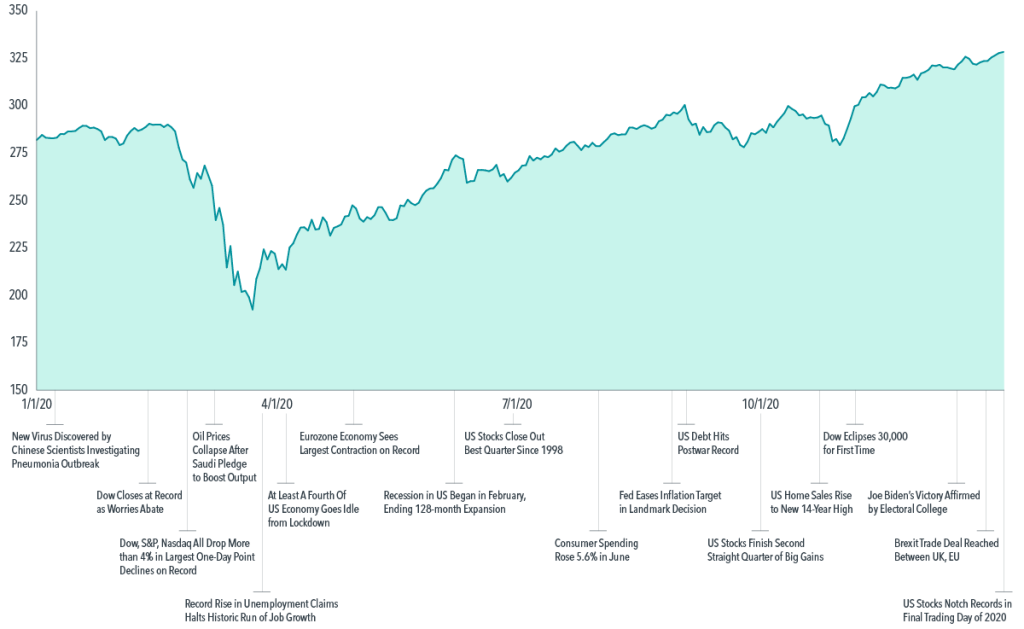

Early in the year the number of COVID-19 virus infections exploded, quickly spreading from China into every corner of the world through the months of January and February. The resulting pandemic altered daily living activities for millions of people and caused economic shutdowns and contractions around the globe, sending national economies and global markets into turmoil.

As the wave of coronavirus infections subsided and economies around the globe reopened, civil unrest proliferated across the US beginning in late May with protests over the killing of George Floyd. Civil unrest and protests continued throughout much of the summer, only dwindling as the focus of our nation turned to the November elections. Marked by record voter turnout, high numbers of mail-in ballots and widespread claims of fraud, the results of the highly contentious election were disputed well into December.

2020: Rich in Returns & Investing Lessons

Despite all the negative news and sharp swings, market returns for 2020 were above historical norms. The S&P 500 Index finished up 18.40%, the MSCI World ex USA Index gained 7.59% and the MSCI Emerging Markets Index returned 18.31% in 2020. Years like 2020 can provide some powerful reminders and lessons for all investors, affirming that a disciplined and diversified investment approach is a reliable method to achieving investment goals. Let’s review some of the more salient lessons that 2020 provided.

Equity Markets & The Economy are Loosely Connected

Shortly after the surge of Coronavirus cases, stock prices plunged precipitously in a very short amount of time. At its lowest point, the S&P 500 Index registered a 33.79% drop in the month of March. As Coronavirus cases exploded to pandemic levels, many sectors of the economy shuttered, most notably restaurants, theaters, travel and bricks and mortar retailers. As the news got more dire, some investors feared the worst and exited equity markets.

But an interesting and unexpected thing happened in April as markets rallied. This led some investors to ask themselves “how could markets be doing so well when the economy is doing so poorly?” The answer to that question is that equity markets frequently recover more quickly than the broader economy. We observed a similar rebound during the financial crisis, when equity markets hit their bottom on March 9, 2009 before beginning the longest bull market in US market history. It would take another seven years for the economy to recover all the jobs lost during the financial crisis.

It is Very Difficult to Successfully Time Markets

During both the pandemic and the financial crisis, investors who sold during the downturns and waited for the economy to recover to buy again missed out on a significant amount of the ensuing market returns. History repeatedly provides evidence that most investors who try to time the markets perform much more poorly than investors who avoid market timing. Investors who sold in March during the swift downturn are still on the sidelines waiting for signs of an economic recovery.

Consider the example of a hypothetical investor who invested in the S&P 500 Index on January 1, 1980 compared to an investor who attempted to time markets during that same time period. Through August of 2020 an investor who missed the five best days during that nearly 40-year time horizon would have a 38% lower return than the investor who stayed invested throughout according to Fidelity Investments.

Diversification is Important

The economic downturn caused by the coronavirus is a prime example of why diversification is so important. The fallout of the downturn and subsequent recovery has been very uneven. Certain industries and market sectors are still suffering, while others have completely recovered. It would have been impossible to anticipate how the pandemic would have impacted industries and companies at the outset of 2020. History has shown that investors have been consistently rewarded for owning a broad range of companies and industries rather than trying to pick winners and losers.

Sticking With Your Plan

Investors are consistently rewarded for exhibiting discipline in the face of market volatility. As we observed earlier this year, the S&P 500 Index fell 33.79% over a five-week period from its peak on February 19, 2020. As more information about the pandemic unfolded, however, markets recovered quickly with the S&P 500 Index jumping 17.57% in three days in March. Over the six-month period from April 1 to September 30, global equities returned 29.54%.

In Conclusion

2020 was a difficult year in many respects. There was no shortage of bad news and events to test the mettle of investors. As the year unfolded, investors who exhibited discipline and adherence to sound investing principles were rewarded with investment returns that surpassed norms for stocks despite precipitous market drops early in the year and uncertainty throughout the year.

While expectations for 2021 are much higher than the year we just concluded, there will always be times of uncertainty for investors to face. Recalling the lessons that the markets taught investors in 2020 can help us keep our financial plans on track to achieving our financial goals.