For many investors, the greatest impediment to financial success is their failure to control two powerful emotions: fear and greed. Fear and greed can distort investors’ perceptions of current economic conditions and financial markets, while diverting their attention from longer term financial goals. Of the two emotions, fear is probably the more difficult to control for most investors and can lead to feelings of panic and helplessness.

It should come as little surprise that COVID-19, better known as the coronavirus, and its virulent spread across the globe is instilling widespread panic and fear among investors in global markets. The COVID-19 virus appears to spread very rapidly and has infected over 100,000 people around the globe and has led to over 4,000 deaths to date. The coronavirus may not be the only reason for investors’ recent jitters, however. One cannot overlook the impact that a recent slump in the global oil market contributes to investors’ fears of a slowing economy. Finally, the realization that the longest-running domestic bull market in history must end someday may be prompting some investors to shed equities prematurely.

As global equity markets tumble into bear market territory many investors are confused, concerned or downright petrified about what this all means for their financial plans and security. Many investors may also be wondering about how they should react and respond to these developments. Before we address the various actions investors can take, however, it is helpful to step back and gain some perspective on the situation.

Some Perspective

We know that markets are very efficient at aggregating and processing information quickly. Most of the times this works to investors’ advantage. There are times, however, when markets decline rapidly as investors process new information as it become available. In the case of the coronavirus, markets have processed a lot of new, primarily negative information in recent days and weeks which have caused steep and sudden market declines. These declines are distressing to most, and downright painful to some investors.

When sudden market declines occur, it is often because investors are forced to process new information quickly and reassess expectations for the future. This involves pricing in things that are unknown to investors. In the case of the coronavirus, investors and the market are pricing in unknown factors such as the mortality and transmission rates of the virus and the overall impact to various industry sectors and local and global economies. As risk increases during periods of heightened uncertainty, the returns that investors demand for bearing that risk also increase, which pushes existing equity prices lower.

The good news for investors is that we have a lot of past data and experiences to draw from, and we know that markets will rebound and investors bearing today’s risk by owning stocks will be compensated with positive expected returns in the future. The bad news is that we cannot tell you when things will turn around, or by how much. Nobody can. But ample evidence exists that shows what past returns have been.

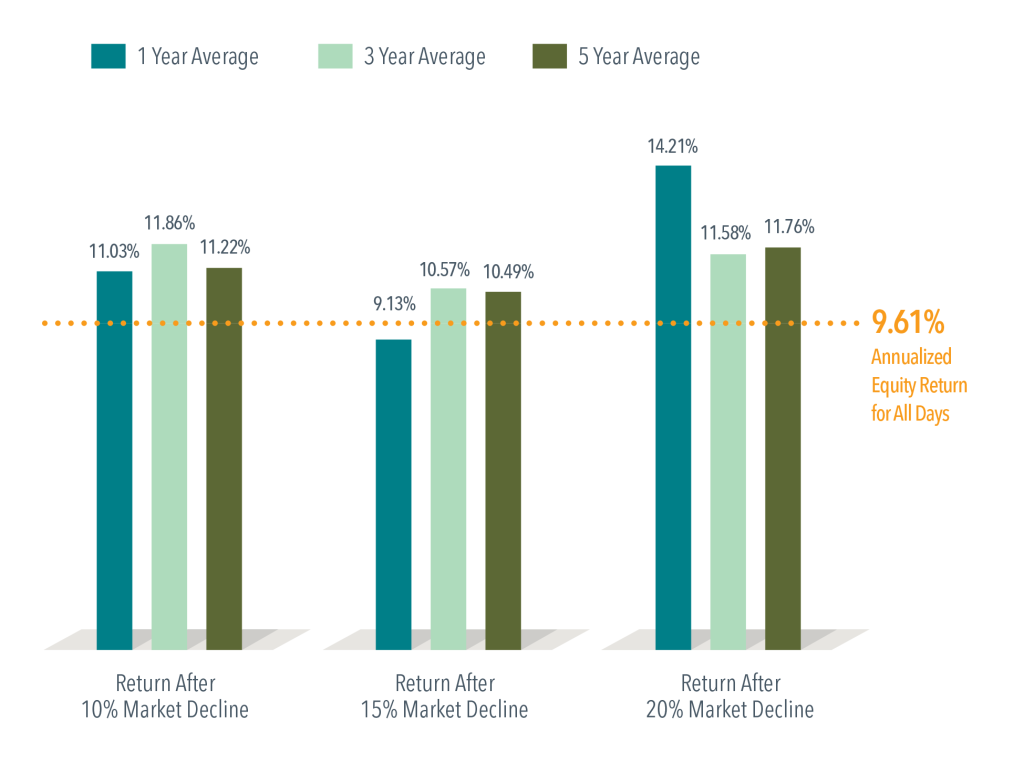

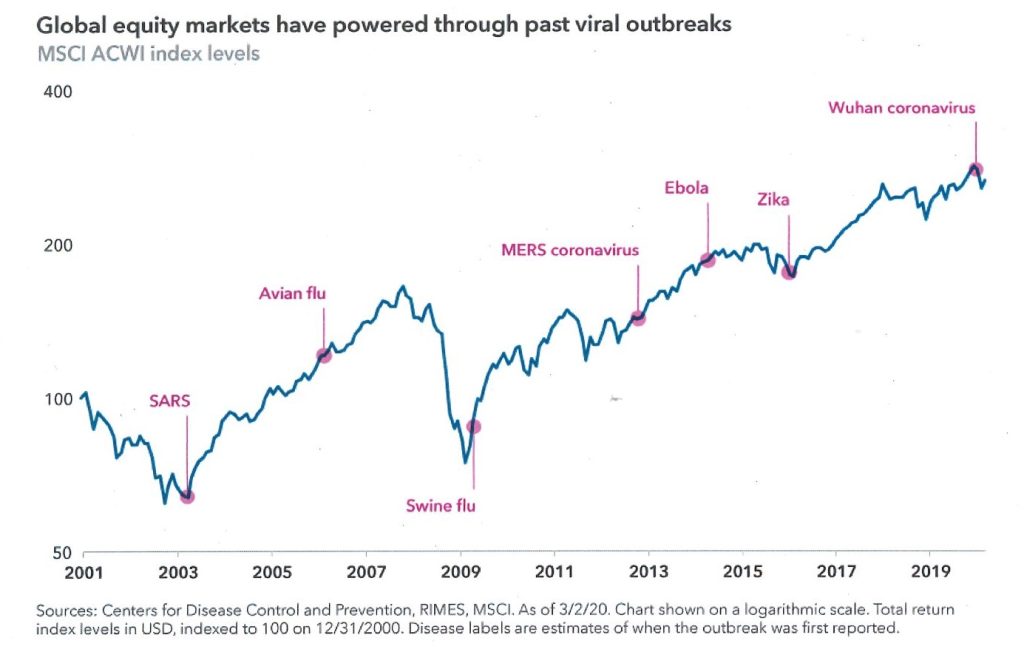

Figure 1 shows how US equity markets have returned over one-year, 3-year and five-year time periods after ten, fifteen and twenty percent market declines from 1926 to 2019. In every data set but one, the market returns over those time periods have significantly outgained the average annualized return of equities of 9.61% for all trading days. Figure 2 shows how global equity markets have responded to past viral outbreaks like Ebola, SARA, the swing flu and the Zika virus. In every instance markets recovered, and patient equity investors have been rewarded with higher returns for their willingness to take on risk.

What Can Investors Do?

We live in a world of non-stop, continuous 24/7 news access, modern conveniences that bring immediate gratification to many of our wants and desires, and a constant bombardment of “noise” from friends and family, social media and more traditional media outlets. Given the fast pace of modern life, it is not surprising that many investors are apt to adopt a “don’t just stand there, do something!” approach to dealing with the recent equity market decline. But is that really the best approach? Here are some tactical maneuvers investors could consider and the potential impact of these actions on their financial plans.

The Flight to Safety

Perhaps this should read “the flight to perceived safety.” In any case, many investors in recent weeks have sold equity positions with breakneck swiftness to position their investment portfolio in asset classes perceived as safe, primarily bonds and cash.

Moving to an all-cash or mostly-cash position helps some investors avoid the pain of watching their portfolios rise and fall with daily market movements driven by the latest news and developments. The problem with moving portfolios to cash is twofold. First, investors lock-in losses when they sell out of their equity positions. Secondly, very rarely is there a clear signal about when it is a good time to buy back their equity positions. We saw this in 2009 when many investors failed to ever return to equity positions or returned late, missing out on significant gains that occurred early in the last bull market. In the meantime, investors gain no return from their cash positions while the purchasing power of their cash positions erode over time due to inflation.

Other investors have sold their equity positions to buy fixed income investments like CDs or government bonds because they are perceived as safe havens during periods of market volatility that will at least provide some investment return. Earlier this week we saw investors’ demand for safety drive the yield on the ten-year Treasury bond down to 0.49%. You read that correctly, some investors are okay with earning less than one-half of a percent annually on a ten-year investment. In the extremely low interest rate environment we find ourselves in, fixed income investments may feel like safe havens, but they are anything but. Investors can suffer significant losses in bond positions, especially when purchased in times of extreme panic. And if investors hold low-yielding bonds or CDs until maturity, they will suffer purchasing power risk as inflation erodes the value of their meager returns.

Instead of adopting tactical moves to make themselves feel better in the short run, many investors have chosen to ride out the market volatility armed with the knowledge that they will be rewarded for their patience and persistence, as figures 1 and 2 showed earlier. Some investors have even chosen to put more of their cash into equity markets during the recent downturn, knowing that they are purchasing assets at a ten, fifteen or even twenty percent discount. As 18th century banker Baron Rothschild is famously quoted as saying, “the time to buy is when there’s blood in the streets.” If investors liked owning stocks earlier this year, they should really like owning stocks when they are this deeply discounted.

This doesn’t mean that it is always easy to own stocks during periods of extreme downward volatility. Market volatility is part of the price investors pay to earn the higher returns provided by equities and can produce some gut-wrenching market rides. But sticking with your investment allocation puts you in the best position to capture equity market recoveries and achieve the financial goals outlined in your financial plan.

Sources: The Wall Street Journal, Dimensional Fund Advisors, Centers for Disease Control and Prevention, Capital Group Companies