The world of finance lost a true titan recently when Dr. Harry Markowitz passed away on June 22nd at the age of 95. While not necessarily a household name outside of the world of finance, Dr. Markowitz forever transformed how investment portfolios are constructed with his revolutionary research.

Prior to Dr. Markowitz’s formative research, the dominant belief in the investing world was that the best strategy for constructing an investment portfolio was to own the shares of companies with the best growth prospects. After Dr. Markowitz published his dissertation, “Portfolio Selection,” the relationship between risk and return was better understood and the landscape of investing was forever altered.

Early Life and Education

Born on August 24, 1927, the only child of Chicago grocery store owners, Markowitz attended the University of Chicago studying Liberal Arts before turning his attention to the field of Economics. Markowitz earned both his Masters degree in 1950 and his PhD in 1954 from the University of Chicago Booth School of Business.

With his seminal research in “Portfolio Selection,” Dr. Markowitz utilized advanced mathematical techniques to show the relationship between combinations of individual stocks and the resulting portfolio’s risk and return characteristics. This research provided a framework for investors to properly assess risk and returns for their portfolios. For the first time ever, the benefits of diversification had been quantified.

Markowitz's Revolutionary Research

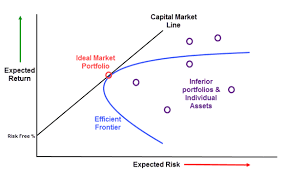

Dr. Markowitz introduced the concept of Modern Portfolio Theory (MPT) in his 1952 essay. Modern portfolio theory provides a mathematical framework for combining portfolio assets in such a manner that the expected return for the portfolio is maximized for any given level of risk. Modern portfolio theory provides quantitative evidence of the benefits of diversification in portfolio construction.

Markowitz’s work on Modern Portfolio Theory provided the basis for other important investing concepts, including the Efficient Frontier. The Efficient Frontier is the set of all portfolio combinations that provide the highest expected return for each given level of risk an investor is willing to accept. The concept of portfolio efficiency in turn led to the development of the capital asset pricing model (CAPM), which provides a model to determine the theoretically appropriate required rate of return for any given investment asset.

CAPM provides another important tool in the development of efficient and well-diversified investment portfolios, which in turn provide better experiences for investors. CAPM, the Efficient Frontier, and Modern Portfolio Theory are all important components of the curriculum taught in all university finance departments today.

Markowitz's Lasting Legacy

For his pioneering work and revolutionary contributions to the world of finance and investing, Dr. Markowitz was awarded the Nobel Memorial Prize in Economic Sciences in 1990 along with William Sharpe and Merton Miller. This award recognized Markowitz’s work in developing Modern Portfolio Theory and its resulting impact on how we practice investment management today.

It is nearly impossible to overstate the importance of Markowitz’s contributions to the world of finance. Harry Markowitz’s pioneering research on Modern Portfolio Theory has had an indelible impact on the field of finance. His work paved the way for subsequent research in behavioral finance and the study of investor psychology, recognizing that human behavior and emotions play a significant role in the financial decision-making process. Markowitz’s ideas continue to guide investment professionals, empower individual investors, and shape the curriculums of finance programs worldwide. His contributions have earned him a well-deserved place among the greatest financial minds of the 20th century, leaving a lasting legacy that will continue to shape the investment landscape for generations to come.

Sources: The Wall Street Journal, New York Times