After one of the most difficult years in decades, 2021 may have been one of the most eagerly anticipated years in recent memory. Emerging from 2020, a year marked by quarantines, lockdowns, cancellations, and economic shutdowns, the entire world longed for a return to some semblance of normalcy. Investors were cautiously hopeful global economies would be strong enough to shake off the COVID-19 pandemic that halted economic growth in 2020 and made investing in equity markets a wildly volatile ride.

2021 illustrated, once again, the difficulty of making tactical financial and investing decisions based on predictions and anticipation of which direction markets would head. The global economy quickly rebounded from the widespread lockdowns that left it gasping and sputtering in 2020. The development and distribution of effective vaccines led to the easing of lockdowns and led to an economic expansion much stronger than most anticipated.

The economic recovery had its own issues to contend with, however. Snarled supply chains and backlogged shipping ports led to severe shortages of goods throughout the year. Labor shortages were felt across multiple industries and contributed to supply shortages in the manufacturing sector and curtailed operations and closures in many service industries.

Long Anticipated Inflation Finally Appears

Markets Return in 2021

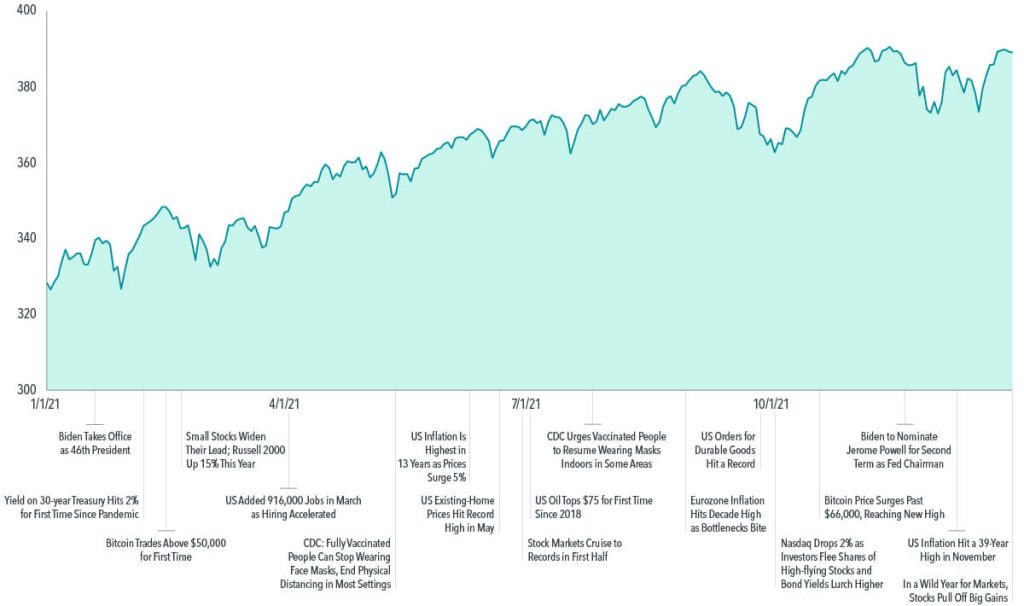

Equity markets performed exceptionally well in 2021, despite some of the economic headwinds mentioned earlier. US large cap stocks led the way for all investment asset classes, ending 2021 near record highs with a 28.71% gain in the S&P 500 index. Driven in large part by tech stocks, the S&P 500 index notched 75 closing records in 2021 on a total return basis!

Global equities also had a strong year. As measured by the MSCI All Country World Index, global equities increased 18.54%. Developed nation international stocks rose 12.62%, represented by the MSCI World ex USA Index. Emerging markets were the only equity asset class that struggled in 2021, as the MSCI Emerging Markets Index fell -2.54% overall.

Fixed income markets, on the other hand, experienced listless returns in 2021. The Barclays Global Aggregate Index lost 4.71% in 2021, its worst year since 1999. Bond markets in the United States did not fare much better. The Morningstar US Core Bond Index finished 2021 down 1.6%, experiencing its worst year since 2013. Corporate bonds performed slightly better than Treasury bonds, with the Morningstar US Corporate Bond Index losing 1.1% in 2021 compared to a -2.3% decline for the Morningstar US Treasury Bond Index. Not every fixed income index experienced a loss in 2021. The Morningstar US High Yield Bond Index gained 5.2% in 2021, while the Morningstar US TIPS Index earned 5.7% in 2021.

Lesson for Investors

Sources: Dimensional Fund Investors, Wall Street Journal, US Department of Agriculture, US Bureau of Labor Statistic