One of the biggest financial stories of 2021 has been the surge in inflation. Disrupted supply chains, shortages of willing workers, rising energy prices and increased consumer spending have all contributed to inflation increases not seen in over a decade.

The Labor Department recently announced that September’s consumer-price index (CPI) increased by 5.4% from the previous year, well above the Federal Reserve’s forecast of 1.8% for all of 2021 made in December of 2020. Many economists expect the same factors that have driven inflation this year to persist at least through the first quarter or two of 2022, and possibly longer. The looming specter of persistently high inflation has left many investors questioning their current strategies. Let’s examine the investment performance of several investment strategies during periods of higher inflation.

Gold & Precious Metals

Historically, some investors have sought commodities, precious metals and most notably gold as an investment refuge during periods of inflation. Research from Vanguard suggests that a 1% movement in the inflation rate is associated with a 7 to 9% movement in commodity prices, at least for short time durations. But are commodities, and more specifically gold, really the best refuge for investors to combat inflation? Let us examine some longer-term data to get the answer to that question.

During the three-decade period from 1990 to 2020, the price of gold increased by nearly 360%. Despite gold’s strong performance, it trailed US large cap stocks by a large margin as the Dow Jones Industrial Average (DJIA) increased by 991% in the same period! Does a longer time horizon matter? Since 1972, when the United States abandoned the gold standard, through 2020 the compound annual growth rate (CAGR) for gold is 7.9%. Over the same time horizon, the S&P 500 Index has produced an annualized return of 10.8%, a difference of nearly 3% annually.

Some investors may be tempted to try to time the market; moving into and out of commodities, gold or between stocks and cash positions, to take advantage of mispricing in the market. The random movements and general efficiency of markets make this a very difficult endeavor, however. Unless an investor believes he has the knowledge or ability to time the market, there is no compelling reason to own commodities, gold or precious metals during periods of high inflation.

Treasury Inflation Protected Securities (TIPS)

The US Treasury began issuing TIPS in 1997, and are generally issued in maturities of five, ten and thirty-years today. TIPS are issued to protect investors from inflation, with the principal value of TIPS increasing during periods of inflation and decreasing during periods of deflation.

Twenty-four years is a short timeframe to draw statistically valid conclusions as investment data goes, and inflation has remained relatively benign (by historical standards) during TIPS’ existence. Data collected by scholars and practitioners during that time has produced a couple of takeaways, however. Data shows that short-term TIPS correlate better with concurrent inflation than longer-term TIPS. But longer durations typically generate more noise in price movement than shorter durations for all types of bonds. Another lesson the data shows is that TIPS have higher correlations with inflation than the treasury market as a whole.

Recent data, seems to confirm the latter conclusion. As mentioned above, the CPI increased to 5.4% by recent measures. The VTIP ETF (an ETF tracking TIPS with five-year duration or less) is up 4.1% for the calendar year, while the aggregate bond ETF is down 0.5% for the year.

We can conclude that TIPS may be an appropriate portfolio holding for investors as a component of their fixed income holdings. TIPS do not immunize the balance of an investor’s portfolio, however, so they are not the complete solution and other asset classes need to be considered.

What About Equities?

Newspaper headlines and social media posts do not typically mention equities when talking about strategies to inoculate portfolios from the ravages of inflation. But history shows that equities tend to outpace inflation over the long-term, as well as the short-term.

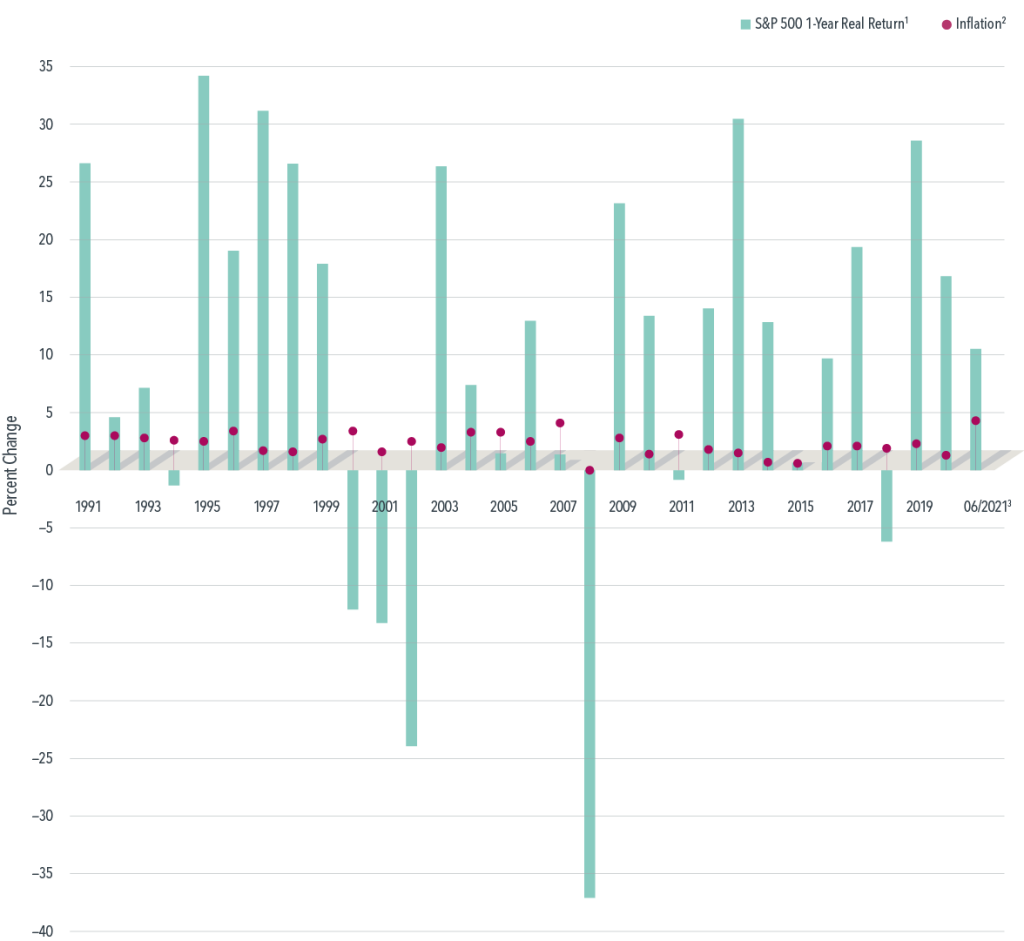

Historical returns for the S&P 500 index show that annualized inflation-adjusted returns for large cap stocks have been 7.3% since 1926. Over the past thirty years, the results have been even better as the S&P 500 index posted an average annualized return of 8.5% after adjusting for inflation! Looking at the long-term and short-term inflation-adjusted returns, we can conclude that there is not any reliable connection between periods of high or low inflation measures and their impact on US equity returns.

Consider the data illustrated in Exhibit 1. Since 1991, one-year returns for US stocks, as measured by the S&P 500 index, have fluctuated wildly. But weak equity returns occurred during periods when inflation was low. Twenty-three of the past thirty years saw positive investment returns, even after adjusting for the impact of inflation. This is also the case for the first six months of 2021!

Implications for Investors

While higher than expected inflation has captured many of the news headlines this year, investors may be surprised to learn that their portfolios and investment strategies may not need to be revisited. We have examined historical returns for three different asset classes.

TIPS tend to reduce the impact of inflation, but their impact is strongest in the short-term inflationary time periods. And TIPS have limited applicability – they should only be used in place of other fixed income investments in a balanced investment portfolio.

Gold and other commodities can be very volatile, and while investors may be rewarded in the short-term if they were to correctly guess twice – when to buy and when to sell their holdings; savvy investors are aware of the difficulty in trying to employ market timing investment strategies. Over the long-term, gold has significantly underperformed US equities in periods of both tame and high inflation.

Historical data shows that equities are the only investment asset class that consistently outperform inflation over long and short timeframes. Owing equities, in the appropriate allocation for an investor’s risk tolerance, consistently provides investors with positive inflation-adjusted returns over time and allows investors to reach their financial goals.

While it may be tempting to tweak investment portfolio holdings in periods of volatility and higher inflation, making changes can work against an investor. Dealing with inflation doesn’t have to be confusing. Contact the financial planners at Bollin Wealth Management to ensure that your investment portfolio is aligned with your financial goals and risk tolerance.

Sources: Seeking Alpha, The Wall Street Journal, Dimensional Fund Advisors, Investopedia, Dow Jones Indices LLC.