Twelve months. One’s perspective on that measure of time inevitably changes as you progress through life and may depend, in part, on your chosen profession or occupation. For many investors, we often measure the passage of twelve months by the returns our portfolio earned.

Twelve months ago, the world we knew was forever altered as we scrambled into lockdown mode as a defense against the threat of the Coronavirus pandemic. As investors, we watched helplessly as the S&P 500 index plummeted nearly 20% in a few short weeks in reaction to this disruption to economies at home and abroad. If you read the newspapers or got your news from the radio or television during this time it was impossible to miss the predictions of what market returns would be over the next year from so-called “experts” and market prognosticators. It is probably safe to say that few of these talking heads predicted the market (as measured by the S&P 500) would be up 56% over the next twelve months, but that is exactly what happened.

The events of the past twelve months should remind us of the folly of trying to predict investment returns or anticipate market movements. Every year, investing gurus offer their opinions on where investment markets will end the year. How often do they report on the accuracy (or lack thereof) of their previous predictions? How often are they held accountable for their forecasts, correct or erroneous? It seems, as investors, we are missing an important feedback loop to help us determine to whom we should or shouldn’t be listening.

We should all realize by now that nobody owns a crystal ball that foretells what will happen in the future, nor can we expect to correctly predict or anticipate market downturns or financial crises. But we can certainly plan for them whenever they do occur. Having a financial plan and investment strategy, tailored to your specific financial circumstances, goals, and risk tolerance is your protection against the random movements of investment markets. Having a solid financial plan and investment strategy will provide you with a disciplined, regimented approach to consistently earn market returns.

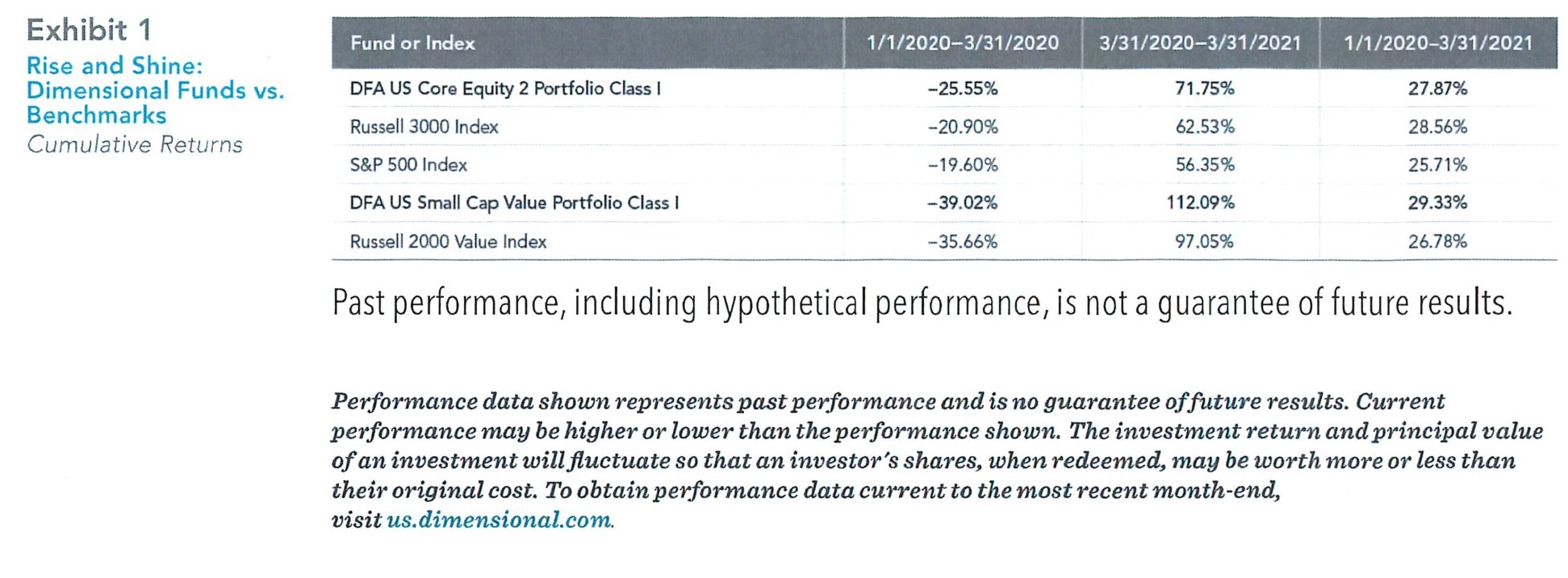

Let’s revisit the events of 2020 to see how a disciplined approach rewarded patient investors. As we can see in the second column of Exhibit 1, the first three months of 2020 were brutally punishing for investors. As noted earlier, the S&P 500 index lost 19.60% of its value in the first three months of the year. The Russell 2000 Value Index, representing 2,000 of the smaller publicly traded U.S. companies and widely regarded as a bellwether for the U.S. economy, fell even further, losing 35.66% of its value. Many investors were distraught and felt pressure to “do something” to try to ease the pain. Some of these investors exited the market to stop the bleeding and reduce their feelings of helplessness and uncertainty. By doing so they actually created more uncertainty for themselves: trying to choose the right time to get back into the market.

While it was anything, but easy, disciplined investors maintained their investment strategies and portfolio allocations through a difficult first quarter, and were rewarded much sooner than many expected. As we can see in column three of Exhibit 1, disciplined investors earned outsized returns over the last nine months of the year. The further the index or mutual fund fell in the first quarter of 2020, the larger the returns were for the remainder of the year.

For a moment, let’s return to the original question in the title of this article. What is normal as it pertains to markets and investment returns? Normal markets are uncertain and unpredictable. Normal markets occasionally experience downturns and financial crises. Normal markets sometimes defy explanation and understanding in the short-term. But normal markets also reward patient and disciplined investors over time.

Another interesting thing about normal markets is that annual returns rarely match their expected annualized returns. Let us look at U.S. Large Cap stocks for example. This asset class has produced a 10% annualized rate of return when we look at the decades of historical data we have collected. Do you know how many years in the past twenty years that U.S. Large Cap stocks had an annual return within 1% of their 10% annualized rate of return? Only one. In 2004, U.S. Large Cap stocks had a 10.88% return for the year. In that twenty-year period, U.S. Large cap stocks have returned as high as 32.39% and lost as much 37.00% of their value in one year’s time.