“Has it been four years already?” That questions is a popular refrain heard frequently as our nation readies itself for our next Presidential election on November 3rd. As expected, the looming election has garnered the attention of news and media outlets for the past few months with an ever-increasing focus on the November 3rd decision date.

The 2020 Presidential election promises to be one of the most contentious elections in the history of the United States. Many voters are understandably concerned about the impact of the election results on a variety of our country’s issues including the health of the economy, jobs and employment, taxes, racial harmony, law and order, healthcare and our country’s response to the COVID-19 health pandemic. With all the bias and bluster among the candidates, the candidates’ supporters, and the media, it can be difficult for voters to decide who will be the better choice to lead our nation for the next four years.

One question that investors frequently pose during election years is “which candidate will be the better choice for the performance of the stock market?” An important question for sure, the prospects for a safe and comfortable retirement for many Americans are greatly influenced by how our equity markets perform. So which candidate is better for stock market returns, and does is matter who wins the November election? The answer to these questions may surprise you.

What Can a President Influence?

One of the first questions we must consider is what factors can a President influence that might enhance or hinder market performance. But before we can answer that question, we must answer another question about what factors influence market returns?

There are a large number of factors that influence investors’ expectations of market returns. Some factors that have a larger influence over the collective expectations of investors for market returns include interest rates, inflation, tax rates, employment conditions and the unemployment rate, government policies and intermarket relationships.

The President of the United States can have varying degrees of influence on the factors the drive investors’ expectations. And to a large extent, the President’s ability to set an agenda and influence markets depends in part on party control of the Senate and House of Representatives, the checks and balances to the President’s power and influence. We have witnessed periods of time where the President has appeared to have a positive influence on market returns, as well as terms where the market has performed poorly. But is this always the case? Perhaps history can provide some clues for which candidate is the better choice for stock market returns.

A Historical Perspective

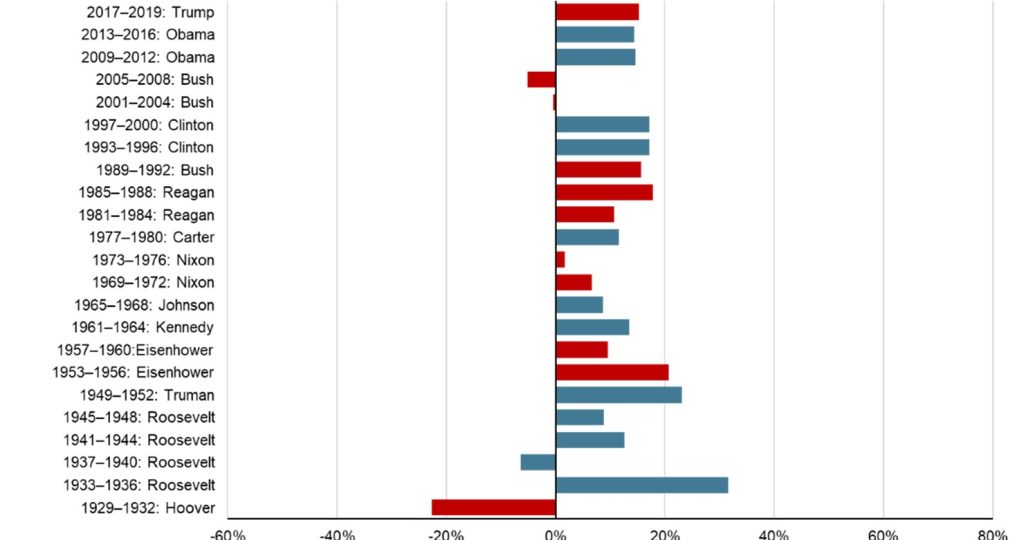

Historical data can provide us with significant insight about market returns during Presidential terms. Fortunately, we have nearly 100 years of data from the S&P 500, representing twenty-three Presidential terms, from which we can draw some conclusions. Of those twenty-three terms, twelve have been Democrats and eleven have been Republicans. Both parties are well-represented in our data.

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect expenses associated with the management of an actual portfolio.

A closer look at the data contained in figure 1 reveals some interesting findings. Among the more interesting data points, is that only four Presidential terms out of the twenty-three had overall negative returns. Not surprisingly, Herbert Hoover had the worst term with a -22.66% annualized rate of return for the S&P 500 Index. But Franklin Delano Roosevelt had a loss in his second term, and both of George W. Bush’s terms resulted in an annualized loss for the S&P 500 Index.

FDR also had the best term in terms of annualized returns, with a +31.62% annualized rate of return in his first term. Harry Truman had the second-best term, with a +23.11% annualized return and Dwight Eisenhower had the third best, returning +20.64% annualized.

Does it Make Sense to Time the Market?

Dimensional Fund Advisors (DFA) dug deeper into the data to determine if it made sense to time the market by not investing for various terms of the two parties’ Presidents.

Here is what the data revealed to DFA. By moving to all cash positions when Republican Presidents were in power and investing in the S&P 500 Index when Democrats were in control, investors earned 6.9% on an annualized basis. Investing in cash while Democrats were in control and investing in the S&P 500 Index during Republican Presidential terms led to a 2.6% annualized rate of return. But investing in the S&P 500 Index throughout all Presidential terms rewarded investors and gave them a 10.3% annualized rate of return. The data clearly illustrates that attempting to time the market by Presidential political party control made investment returns worse!

From an investment return and retirement planning perspective, it does not appear that either Presidential candidate holds a significant advantage over the other in terms of how domestic equity markets perform. Furthermore, we know that attempting to time the market is essentially a futile effort as market expectations about election outcomes are always being embedded in security prices on a daily basis as more information comes to light.

Be sure to exercise your right to vote in November’s election. But understand that the election decision in November has little bearing on the returns the market earns in the coming years. And that is the way you want it to be as an investor!

Sources: The Wall Street Journal, Dimensional Fund Advisors, Dow Jones Indices, LLC.