We have been in a low interest rate environment for quite a few years now, but the Federal Reserve has signaled its intention to raise interest rates throughout 2017. In recent months, several clients have asked the question of how rising interest rates would affect stock prices in the coming months. Realizing that many of you may have the same question, we address the topic here.

Unlike bond prices, which tend to go down when yields go up, stock prices might rise or fall with changes in interest rates. For stocks, it can go either way because a stock’s price depends on both future cash flows to investors and the discount rate they apply to those expected cash flows. So, if theory does not tell us what the overall effect should be, the next question is what does the data say?

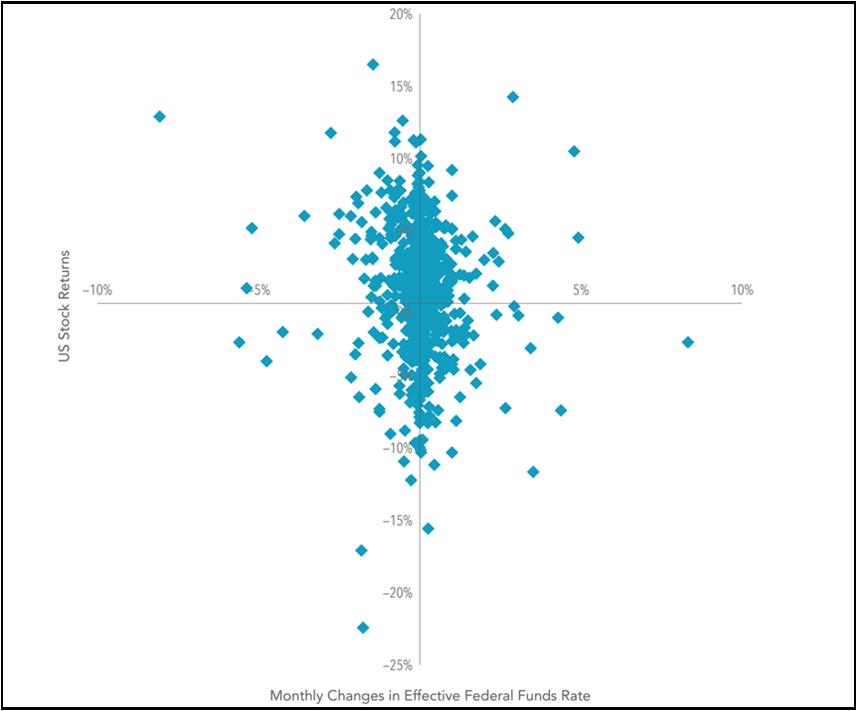

Recent research performed by Dimensional Fund Advisors helps provide insight into this question. Their research examines the correlation between monthly US stock returns and changes in interest rates. Figure 1 shows that while there is a great deal of noise in stock returns and no clear pattern, not much of that variation appears to be related to changes in the effective federal funds rate.

For example, in months when the federal funds rate rose, stock returns were as low as –15.56% and as high as 14.27%. In months when rates fell, returns ranged from –22.41% to 16.52%. Given that there are many other interest rates besides just the federal funds rate, DFA also examined longer-term interest rates and found similar results. So to address our initial question: when rates go up, do stock prices go down? The answer is yes, but only about 40% of the time. In the remaining 60% of months, stock returns were positive. This split between positive and negative returns was about the same when examining all months, not just those in which rates went up. In other words, there is not a clear link between stock returns and interest rate changes.

In conclusion, there is no strong evidence that investors can reliably predict changes in interest rates. Even with perfect knowledge of what will happen with future interest rate changes, this information provides little guidance about subsequent stock returns. Instead, staying invested and avoiding the temptation to make changes based on short-term predictions may increase the likelihood of consistently capturing market returns.

Source:Dimensional Fund Advisors