We have all heard the old adage “You get what you pay for” at one point or another in our lives. We understand the adage to generally mean that inexpensive items and services tend to be inferior, or of lower quality, than more expensive items or services. We understand that with most things in life you have to pay a little more for items or services of higher value.

For example, we expect to pay more for a shopping experience at Nordstrom than we would at Target or Sears because of the quality of the merchandise and the level of service shoppers receive at Nordstrom. Drivers expect certain luxuries and a different driving experience when they purchase a premium brand like a Lexus or Lincoln automobile. Likewise, we expect a more satisfying dining experience when we eat at a sit-down restaurant as opposed to a fast food restaurant. We expect the more satisfying dining experience to be reflected in the cost of the meal.

So when investors purchase mutual funds with higher costs they should expect a better investing experience, right? Investors should expect that more expensive investments would provide higher investment returns with lower volatility than what investors experience with less expensive investment options. But is that what really happens?

Before we answer that question, we first need to discuss mutual fund costs, which generally consist of two types of costs. The first cost is the stated expense ratio, which tells investors what they can expect to pay for the mutual fund’s investment strategy. We can think of the mutual fund expense ratio as being similar to the sticker price of a car. The expense ratio reflects the fund’s investment management fee and expenses for fund accounting and shareholder reporting. This cost of the mutual fund is explicitly communicated to investors, just like the purchase price of a vehicle is explicitly communicated to the car buyer.

There are also costs of ownership that are not as obvious. For the owner of a vehicle, insurance, maintenance, fuel consumption and registration are all costs of ownership that are not explicitly communicated to the vehicle’s owner at the time of purchase. Mutual funds also have costs that are not obvious: trading costs. Depending on the management style of the fund, trading costs can be substantial and have a great impact on the fund’s investment returns. Trading costs are a function of the frequency of trading (a number tracked as turnover) and the cost of each transaction. When managers trade excessively, or trade under unfavorable conditions, the transaction costs can rapidly eat away at investment returns.

Let us go back to the question at hand, before our diversion into the two main cost factors for mutual funds. Do mutual funds with higher costs mean the investor will receive higher investment returns? After all, if the fund has a high expense ratio it must mean that the fund is run by an above average management team (commanding higher management fees) that ensures higher investment returns.

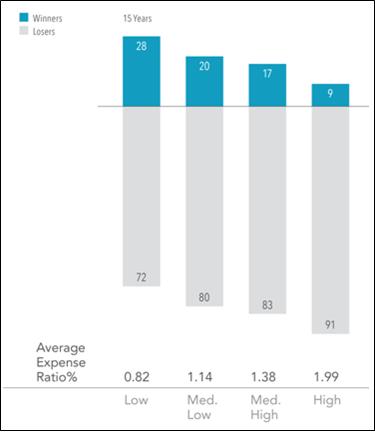

To answer this question, let us examine a data sample of mutual fund performance over a fifteen-year time frame ending on December 31, 2016. Figure 1 contains data from Morningstar and the Center for Research in Securities Prices (CRSP) from the University of Chicago. Mutual funds were divided into quartiles based on expense ratios, and the performances of the funds were measured to determine “winners” and “losers.” Winners were determined to be funds that both survived and outperformed their respective Morningstar category benchmark. Losers were funds that either did not survive the entire fifteen-year period, or under-performed the respective Morningstar category benchmark.

The data tells a compelling story about expenses and fund performance. During the fifteen-year period through 2016, only nine percent of the highest-cost equity mutual funds outperformed their benchmarks. Twenty-eight percent of the equity mutual funds in the lowest-cost quartile outperformed their benchmarks. The percentage of equity mutual funds that outperformed their benchmark decreased for each successive quartile of higher expense ratios.

Conclusion

The data in Figure 1 shows that a mutual fund’s expense ratio has a direct impact on the mutual fund’s investment performance. As expense ratios increase, the percentage of funds (winners) that outperform their benchmarks rapidly dwindles falling by sixty-eight percent from the lowest expense ratio quartile to the highest expense ratio quartile. Furthermore, because higher expense ratios are associated with actively managed mutual, we can also conclude that actively managed funds, as a group must necessarily under-perform passively managed or index funds, which generally have very low expense ratios. This data helps explain why more and more investors have fled high expense actively managed funds for low-cost funds like the offerings of Vanguard or Dimensional Fund Advisors (DFA) over the last decade.

While you may “get what you pay for” in most aspects of life, we now have definitive proof that investments are not one area where higher costs means higher quality or better performance.

Sources: Dimensional Fund Advisors (DFA), Morningstar, and the Center for Research in Securities Prices (CRSP) from the University of Chicago.