Nominal interest rates are currently below zero in many countries, including Germany, Denmark, Switzerland, Sweden, and Japan. These levels have shattered the belief that zero is the lowest that interest rates can go. While negative nominal rates are a relatively new phenomenon, historically speaking periods of widespread negative real returns across countries have been quite common.

Those of us who have lived a few decades are aware of the negative impact inflation has on our purchasing power. Real rates of return are adjusted for inflation, so they account for changes in the purchasing power of a dollar over the life of an investment. Because inflation affects the cost of living, investors must consider the inflation-adjusted—or real—return of their investments. When inflation outpaces the nominal returns on an investment, investors experience negative real returns and actually lose purchasing power.

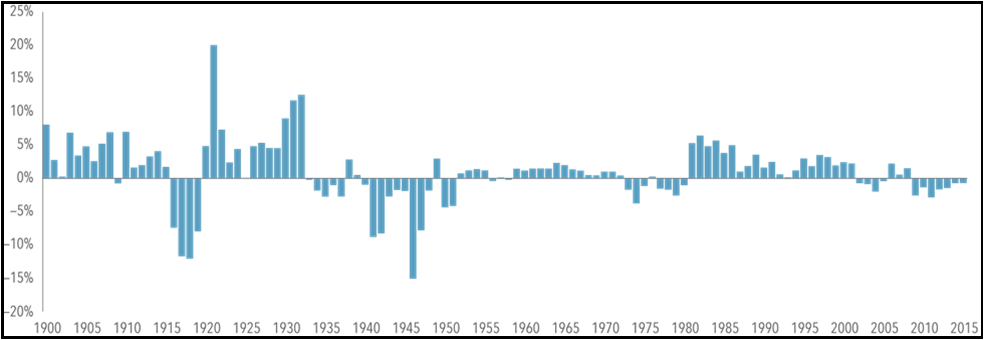

The graph below shows the annual real returns on one month US Treasury bills from 1900 to 2015. From 2009 to 2015, we observe that the annual real return was negative. This situation is not unprecedented. Since 1900, the US has had negative real returns in over a third of those years. And negative real returns on government bills are not exclusive to the United States.

In the current low-yield environment we are in, rolling over short-term bills may not seem appealing to investors interested in protecting their purchasing power. But even when the real return on Treasury bills is negative, which is a relatively common occurrence, bond investors may still achieve positive expected real returns by broadening their investment universe. The bond market is composed of thousands of global bonds with different rate and return characteristics. Many of those bonds allow investors to target global term and credit premiums, which in turn may provide positive real returns even in low interest rate environments.

Global diversification is often thought of as a tool for reducing risk for equities. When it comes to fixed income, global portfolios can also play an important role in the pursuit of increased expected returns. Even if the expected real returns of bonds in one country or region are negative, another yield curve may provide positive expected real returns. The flexibility to pursue higher expected returns by investing in bonds around the world can be an important defense against low, and even negative yields.

The goal of many investors is to grow most, if not all, of their savings in real terms. Even in a low interest rate environment, there may be bond investments that can still achieve this goal. In particular, investors who target global term and credit premiums should be better positioned to pursue higher expected returns. This is the reason that we use globally diversified fixed income and equity in constructing portfolios for our clients.

If you have questions about the real returns your bond portfolio is receiving or, if you would like a second opinion on your portfolio allocation, call us at 419-878-3934. We are always happy to share our thoughts and recommendations.

Source: Dimensional Fund Advisors