Dimensional Fund Advisors (DFA), the mutual fund complex we place most of our clients’ assets with, employs quite a variety of professionals on its staff. As you would imagine, many of the people who work for DFA are quantitatively oriented with degrees in finance. On the opposite end of the spectrum is Weston Wellington, who holds a Bachelor of Arts degree in history from Yale University. Weston has worked with DFA since 1995 and provides some of the most interesting and thought-provoking presentations and articles on the topics of investing and finance that I have come across.

Weston recently posted an article entitled Should Investors Sell After a “Correction”? which offers some perspective on market corrections. I’m going to take some of Weston’s thoughts and expound on them for this article. If you would like to read Weston’s thoughts in their entirety the full two-page article is available on DFA’s website, www.dfaus.com or you can request a copy from our office.

Early in Weston’s article, he points out that most financial professionals describe a market “correction” as any decline of 10% or more. Using that definition, we entered into correction territory in late August for the S&P 500 from its record high on May 21st. And if you have been following the markets all along, you know that the S&P 500 has declined even further in the month of September too.

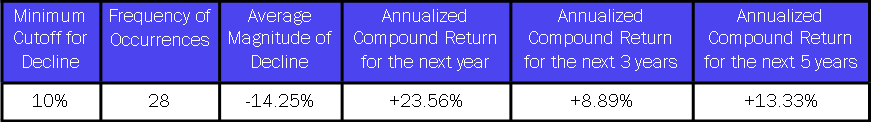

Market “corrections” or declines are normal occurrences of a healthy-functioning and efficient marketplace. Markets reflect all of the information that is available at that time, and new information will make markets move higher or lower as it becomes known. Market declines of 10% or more are not that common, yet they have occurred 28 times between January of 1926 and June of 2015. And each and every time we have experienced a correction the market has completely recovered, although the amount of time required for the recovery varies with each occurrence.

When we experience these corrections it invariably leads to discussions with some clients weighing the merits of selling equities and waiting for the dust to settle before repurchasing them, presumably at a lower price. As most of you know this is what is commonly referred to as “market timing.” And most of you also know that it is very difficult to master both of the steps necessary for successfully timing the market: determining the right time to sell and the right time to buy into the market again.

A Better Way

One of the problems with trying to time the market is determining when to get out of the market, and then again when the time is right to get back in. There are no reliable signals for either instance. The data provided by Dimensional Fund Advisors suggests that investors may do better by avoiding market timing all together.

If we look at the data in the table, we can see that the average overall decline for each of the 28 corrections since January of 1926 is 14.25%. We can also see in the next column that the average return for the next year after the correction is 23.56%. We know that it requires a higher return to get back to even after a market decline. After a 14.25% market decline, an investor needs to earn 16.62% to regain everything lost in the decline. As we indicated earlier, the average return the year after the correction is 23.56% meaning that investors earn almost 7% more (23.56% minus 16.62%), on average, for their patience exhibited in riding out the market correction.

Where Do We Go From Here?

We officially entered correction territory on August 24th, when the S&P 500 declined 12.35% from its record high of 2130.82 on May 21, 2015. But as of the market close on September 30th, the S&P 500 had regained 1.4% from the August 24th close. Is this 1.4% gain a brief one month respite from the market’s 29th correction, or part of a longer-term market recovery? Only time will tell which it is, but we know it really doesn’t much matter in the bigger picture.

The data in the table shows that investors are rewarded for their patience in volatile markets. While it is very tempting to try to limit short-term losses during market corrections, the risks of missing out on the subsequent recoveries are too great. Investors need to remember that to earn the higher expected returns that equity markets provide they need to be able to ride out short-term periods of volatility characteristic of efficient markets.