Most Midwesterners are all too familiar with the phrase “if you don’t like the weather now, wait five minutes.” We know from experience just how volatile our weather conditions in this part of the country can be at times. In light of recent market volatility, maybe we could modify the expression slightly to say “if you don’t like the market returns now, wait until tomorrow.”

In recent weeks, fallout from the collapse of oil prices, concerns about the stability of economies in Europe and Asia, and the plunge of the ruble and rapid interest rate hikes in Russia have whipsawed markets worldwide and panicked investors.

But more recently, the Dow Jones Industrial Average had its best one-day return since 2011, and the S&P 500 had its best one-day gain since January of 2013. The Federal Reserve announced on Wednesday the 17th that it would be “patient in beginning to normalize the stance of monetary policy.” This statement was interpreted by many to indicate the Fed isn’t planning any interest rate hikes until mid-2015 or later, and helped propel U.S. markets significantly higher afterwards.

Such day-to-day market volatility can make it very difficult to remain disciplined and patient with your portfolio allocations and investment strategies. In his June 13, 2014 Wall Street Journal column, Jason Zweig asked readers if they were ready for the next market crash. Citing a series of published experiments, Mr. Zweig observed that the stress of collapsing stock markets fundamentally changes how many people make financial decisions.

We don’t have to go too far back in history to recall the most recent collapse from 2007 to 2009. I can still vividly remember the conversations with panicked clients, the reassurances given that clients would be fine if they were disciplined, and the weekly barrage of questions coming from clients created by the most recent news report. Those were some of my darkest days as a financial planner, but I am comforted by knowing that the clients who remained disciplined in their asset allocations emerged from the collapse in an even stronger financial position than they were before the market collapse.

Dan Wheeler, Director of Global Financial Services at Dimensional Fund Advisors (DFA) from 1989 to 2010, wrote in a recent blog post that advisors should conduct the equivalent of a fire drill with clients so they can avoid panic when the next market downturn happens. We all remember fire drills from our school days, shivering in the winter cold while we practiced an orderly exit from the building and waiting for the signal that we could return to the warmth of our classrooms. So let’s depart the comfort and warmth of the past five year’s market returns, and revisit the icy chill of the past five major market declines as part of our “investor’s fire drill.”

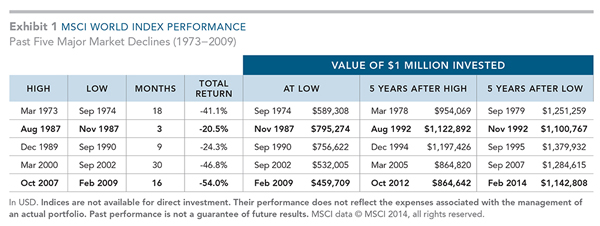

Let’s take a look at how the MSCI World Index performed during the past five major market declines of 20% or greater since 1970.

As you can see from Exhibit 1, the smallest and shortest decline occurred in 1987, lasting only 3 months and losing 20.5%. The largest decline occurred most recently, in October 2007 to February 2009 with a 54% decline, and the longest decline was March 2000 to September of 2002 at 30 months.

As the data shows in each market decline, the subsequent recovery five years after the low point in the market saw at least a 10% gain from the initial investment of $1 million at the high point of the market. The highest gain occurring five years from the low was almost 38%. Clearly the patient and disciplined investor, who does not panic in the face of market downturns, will be rewarded over time.

We know that many investors become their own worst enemy during the stressful times that combine falling stock prices and the uneasy feelings associated with bad economic news. Having the knowledge and foresight to understand that it “isn’t different this time,” and that we have experienced these conditions before may help you keep the discipline long enough to “wait until tomorrow” for market conditions to change.

Sources: The Wall Street Journal, Dimensional Fund Advisors, http://wheelerwrites.com.