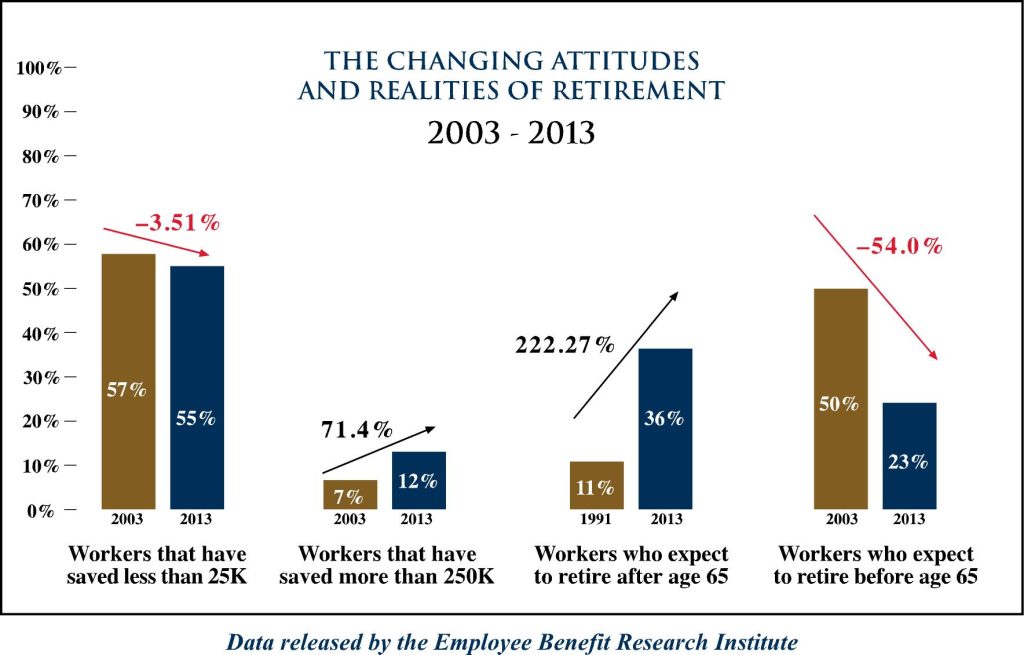

Not surprisingly, the report found that the age at which workers expect to retire is also rising. In 1991, only eleven percent of workers expected to retire after age 65. Twenty-two years later in 2013, thirty-six percent of workers expect to wait until after age 65 to retire, and seven percent of workers surveyed don’t expect to retire at all. In 1991, fifty percent of works expected to retire before age 65. In 2013, only twenty-three percent expect to do so. According to the Retirement Confidence Survey, the top three reasons cited by workers for the delayed retirement age are the poor economy (twenty-two percent), lack of confidence in Social Security (nineteen percent) and their inability to afford retirement (nineteen percent).

The survey also shows disconnects in retirement expectations versus the reality retirees face. The survey’s results showed that in 2013, almost half (forty-seven percent) of all retirees retired earlier than they planned. The survey found that those who retire early often do so for negative reasons, such as poor health or disability (fifty-five percent). But some respondents said that they retired earlier than expected simply because they could afford to do so (thirty-two percent).

In addition to high unemployment, volatile financial markets, and a sputtering economic recovery workers also have little confidence in Social Security or Medicare continuing to provide benefits of at least equal value to the benefits retirees receive today. In two separate polls, sixty-nine percent of workers were not too, or not at all confident that either program will be able to continue current benefit levels in the future.

In spite of all the gloom, there were some bright spots in the report. Twelve percent of workers surveyed reported having savings of $250,000 or more in 2013. In 2003, that number was only seven percent, which represents a seventy-one percent increase over the past decade. And the study found that workers who participate in a retirement savings plan at work (forty-five percent) are considerably more likely than those who are offered a plan but choose not to participate (twenty-two percent) or are not offered a plan (eighteen percent) to have saved at least $50,000.

With equity markets off to a strong start for the first quarter of 2013, it seems likely that the 2014 survey results could show a slight improvement over the 2013 survey. But the message to Americans is clear, we need to save more! In today’s economy, workers are increasingly more responsible for their own comfortable retirement, and those workers who diligently participate in workplace retirement plans are over twice as likely to have achieved a significantly higher level of savings.

Sources: Wall Street Journal, Employee Benefit Research Institute