In recent years, a lot of attention has focused on the state of retirement, more specifically the risk that retirees will outlive their money. Furthermore, in most surveys circulating about retirement today, running out of money during retirement continually tops retirees’ lists of fears and concerns.

Retirees’ fears about retirement are far from unfounded as they do face many risks. Uncertainty about inflation, particularly the rapidly rising cost of healthcare, is a big concern for retirees. Longer life expectancies require nest eggs to sustain a 30-year, or longer, retirement. With 2008 fresh in many people’s memory, retirees are also concerned about their long-term retirement prospects when a severe market downturn occurs early in their retirement, a risk known as returns sequence risk. Moreover, with pension plans rapidly becoming a relic of generations past, retirees feel more pressure to make the right financial decisions with their retirement assets.

A recent publication tells a much different story about retirees and their nest eggs, however. The article’s author, Michael Kitces, says many retirees actually face very little risk of running out of money during retirement if they follow some important guidelines. For those of you not familiar with Mr. Kitces, he is the practitioner editor for the Journal of Financial Planning and author of the blog Nerd’s Eye View, widely followed by many financial planning professionals.

Before we look at the findings of the publication, it is important to dispel a couple commonly accepted misconceptions about retirement. One misconception is that your retirement assets stop growing when you retire. While most retirees do move to a more conservative asset allocation as they approach retirement, their retirement portfolio must continue to grow in order to provide income and protect against the ravages of inflation. Another common misconception is that once you hit retirement age, you have reached the stage of life where you start spending down your retirement savings. Most retirees will eventually start spending down retirement savings, but it does not happen as soon as you retire, generally.

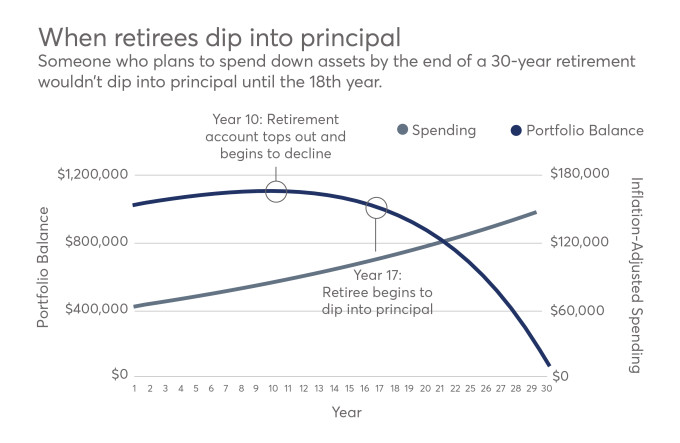

Let us look at an example that Michael Kitces uses to illustrate when retirees start to dip into the principal of their retirement savings. In this example, we will assume a retiree with a $1 million balanced portfolio that earns 8% every year, while inflation runs at 3%. (Both the 8% portfolio return and 3% inflation numbers are very near the historical averages for the last 100 years.) The retiree plans to spend down all of the assets by the end of a 30-year retirement.

In this example, the retiree starts with $61,000 initial withdrawals (6.1% of the $1 million starting nest egg) and adjusts withdrawals for inflation annually.

This example illustrates a couple points. First, the retirement account continues to grow through the first ten years in spite of the annual increases in withdrawal amounts. Secondly, it is only at year 17 where the retiree begins to dip into the principal of the retirement portfolio. From there, the account slowly depletes over the next 13 years. This example effectively disproves the two misconceptions we mentioned earlier.

If only it were that easy! But nobody knows how long retirement will last, and that uncertainty introduces risk (longevity risk) into retirement income planning. The solution to this risk is to follow a strict 4% withdrawal rate, annually adjusting for inflation, which has been back tested historically. No doubt, many of you are familiar with the 4% rule-of-thumb for retirement portfolio withdrawals. Now you know the origins of the rule!

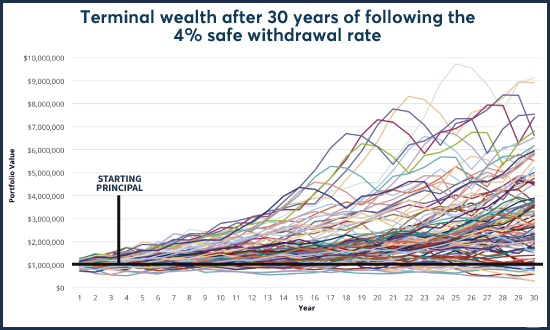

So let us look at a more realistic example of how a retirement portfolio provides income with historical data. In this case, our retiree begins with a $1 million portfolio, invested 60% in stocks and 40% in fixed income investments. The portfolio is rebalanced annually, and a 4% withdrawal rate (adjusted annually for inflation) is used. Actual 30-year rolling returns, going all the way back to 1870, were used to determine how the portfolio would have performed historically.

While it is impossible to follow each retirement portfolio path, we can see some overwhelmingly obvious trends. In the graphed results displayed above, there are a small number of 30-year portfolio paths that finish below the starting principal value of $1 million.

But in two-thirds of the 30-year scenarios, the retiree finishes with more than double their starting wealth. Moreover, the retiree is more likely to quintuple their starting wealth than she is to finish with less than her starting principal, under these historical return scenarios.

The historical data scenarios suggest that the majority of retirees will finish with well more than their original principal wealth amount, and should reassure retirees that there is very little risk of running out of money during a 30-year retirement, and more than-likely a retirement lasting longer than 30 years.

Sources: Michael Kitces, OnWallStreet