In early April a major milestone was reached in the investment advice industry. On April 6th, 2016 the Department of Labor revealed its new fiduciary duty rule that requires financial advisors to act in their clients’ best interest when making investment recommendations on retirement accounts. The new fiduciary duty rule reflects efforts that were first proposed six years ago. It is interesting to note that the Department of Labor was able to create this ruling while the Securities and Exchange Commission (SEC), the regulatory arm of the government responsible for investment professionals, has been unable to come to a uniform standard of care on its own.

While this ruling represents an improvement in the standard of care some investors will receive, there is still more work to be done to ensure that all investors are protected from the deceptive practices of some unscrupulous financial advisors.

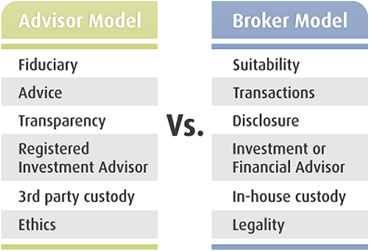

What may surprise many readers to know is that all financial advisors have not been required to provide recommendations that were in their clients’ best interests, and going forward there will be exceptions to this requirement. Traditionally, advisors have been held to two standards. Financial advisors who work for Registered Investment Advisors are held to the fiduciary standard, which requires them to act in their clients’ best interests at all times, and with all financial and investment-related recommendations. Financial advisors who work for brokerage firms, on the other hand, have only been required to make investment recommendations that are ‘suitable’ for their clients’ financial situation. As you can imagine the definition for a suitable recommendation seems to have a lot more ambiguity and wiggle room for advisors than the mandate to act in their clients’ best interests.

So what will change with the new ruling? Beginning in April of 2017, when the new ruling begins going into effect, all investment advisors and brokers must adhere to a fiduciary standard of care when working with clients who own assets in 401(k)s, IRAs, and other ERISA-covered plans. This will presumably lead to a decrease in the recommendation of high-commission investment products being sold, and an increase in the number of clients working with advisors under a fee-for-service arrangement. Under a fee-for-service arrangement the compensation structure for the advisor does not change based on the nature of their investment recommendations.

While the regulation is a step in the right direction, it is not without its critics. Chief among the complaints about the new rule are the significant number of exemptions contained in the regulations that allow brokers to continue to recommend proprietary investments, high-commission investments such as variable annuities, fixed index annuities and non-traded real estate investment trusts (REITs). Brokers will still be able to sell the aforementioned products if both the broker’s firm and the client sign a Best Interest Contract Exemption (BICE). The Best Interest Contract Exemption commits the advisor to put his or her client’s best interests first. But some view this commitment to put the client’s best interests first as hollow, at best.

Another shortcoming of the fiduciary rule is that it doesn’t cover non-qualified (non-retirement) accounts. While the new ruling gives investors with retirement accounts a reasonable assurance of non-biased advice, they have no such assurances of receiving advice with their best interests in mind for their non-retirement investment accounts while working with a broker. Brokers providing advice on non-retirement investment accounts will continue to be held to the suitability standard under current rules.

It is important to remember that a lot of things can happen between now and when the fiduciary rule begins implementation in April of 2017. The ruling may face numerous lawsuits from banks, brokerage firms and insurance companies in an effort to thwart its implementation. Banks, brokerage firms and insurance companies have been lobbying vigorously against the fiduciary standard of care for decades, and are responsible for the watered-down fiduciary rule we have today with the Best Interest Contract Exemption and the fact that it has taken six years to get this far. Commission revenue, proprietary investment products, and high commission investment products like many types of annuities provide a significant amount of revenue to banks, brokerage firms and insurance companies; so they are not likely to roll over on this matter any time soon.

On a more positive note, this ruling may prompt the SEC to finally address the dual standards of conduct that currently exist and adopt more stringent rules governing financial advisors’ behavior. Now it could take several more years to get the SEC to move on this, but the Department of Labor has provided a blueprint to get things moving soon. And there is still hope that the Department of Labor will strengthen the regulations to reflect true fiduciary standards and eliminate wiggle room for brokers like the Best Interest Contract Exemption.

If nothing else, the Department of Labor’s fiduciary rule has increased public awareness about the two standards of care that financial advisors operate under: the fiduciary standard and the suitability standard. And even if nothing else changes regarding the way these two types of advisors are regulated by the SEC or DOL, then the investing public has been made aware of the different types of advice they receive from both. Even before the Department of Labor’s fiduciary rule was announced, investors have been able to guarantee that they received the highest standard of ethical advice from a financial professional by choosing to work exclusively with Registered Investment Advisors (RIAs). Investors can also ensure they receive even higher quality advice by choosing to work with professionals who hold an advanced designation like the CFP® or ChFC® in addition to delivering their advice as Registered Investment Advisors.

Readers with questions about the different standards of advice, or how to find out if your advisor is operating under the fiduciary standard are invited to call our office at 419-878-3934. We will be happy to answer any questions you may have.